Table of Content

You can call us or book an appointment through our website and a mobile loans officer will visit you at your convenience to assist you with the process and to answer your questions. It means every payment you make goes towards settling interest and reducing your principal balance. The interest is computed based on the principal balance remaining after each payment is made.

Home Equity loans offer a longer repayment period, usually until the end of the mortgage. Financial institutions on average use up to 90% of the equity available in the home to finance your project. Loans secured by equity are usually offered at better terms which make them much more affordable. The interest rate on a home equity loan—although higher than that of a first mortgage—is much lower than that of credit cards and other consumer loans.

SBA loan rates 2022

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

Mortgage “points,” or loan discount points, are prepaid interest that reduce your rate on most loan types. Points cost more upfront, but may make sense long-term to save on interest. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

JMMB Group Limited | Equity Analysis

That will increase the value of your property, but they can also be used for other life expenses such as paying off high-interest credit card debt, covering college tuition or building a business. Equity is the difference between your home’s value minus what you owe on your mortgage. Tapping your equity through a home equity loan is just one way to access it, and unlike some types of loans, it will allow you to get the full amount upfront. But to make sure it’s worth the cost to finance, it’s important to first calculate how much you will pay in interest. TD Bank has among the lowest interest rates that are not just an initial teaser rate—it’s for the life of the loan. The 4.49% starting APR is specifically for its 10-year home equity loan.

A home equity loan gives you a lump sum of cash, which you pay off with consistent monthly payments in addition to your current mortgage payment. Home equity loans usually have fixed rates and because your home serves as collateral, rates are typically lower than unsecured loans, like credit cards. Home equity loans are also called second mortgages or home equity installment loans. Today’s mortgage rates vary with market conditions, but the rate you’re offered also depends on the riskiness of your financial profile. A lender must assess whether they believe you’ll repay the home equity loan on time.

What is a home equity loan?

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Old National home equity loans are available in seven states currently. Here are a few of the key advantages and disadvantages of home equity loans.

The max is prime plus 6.5 percent for loans of $50,000 or less, and Prime plus 4.5 percent for larger loans. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes. When determining if a self-employed individual qualifies for a mortgage, we look at the person’s credit history, which is represented by a score, and the person’s ability to repay. The ability to repay is determined by adding the proposed mortgage amount to your existing loans. The total monthly repayment should not exceed 45% of your income. Speak to a mortgage adviser for special rates that may exist.

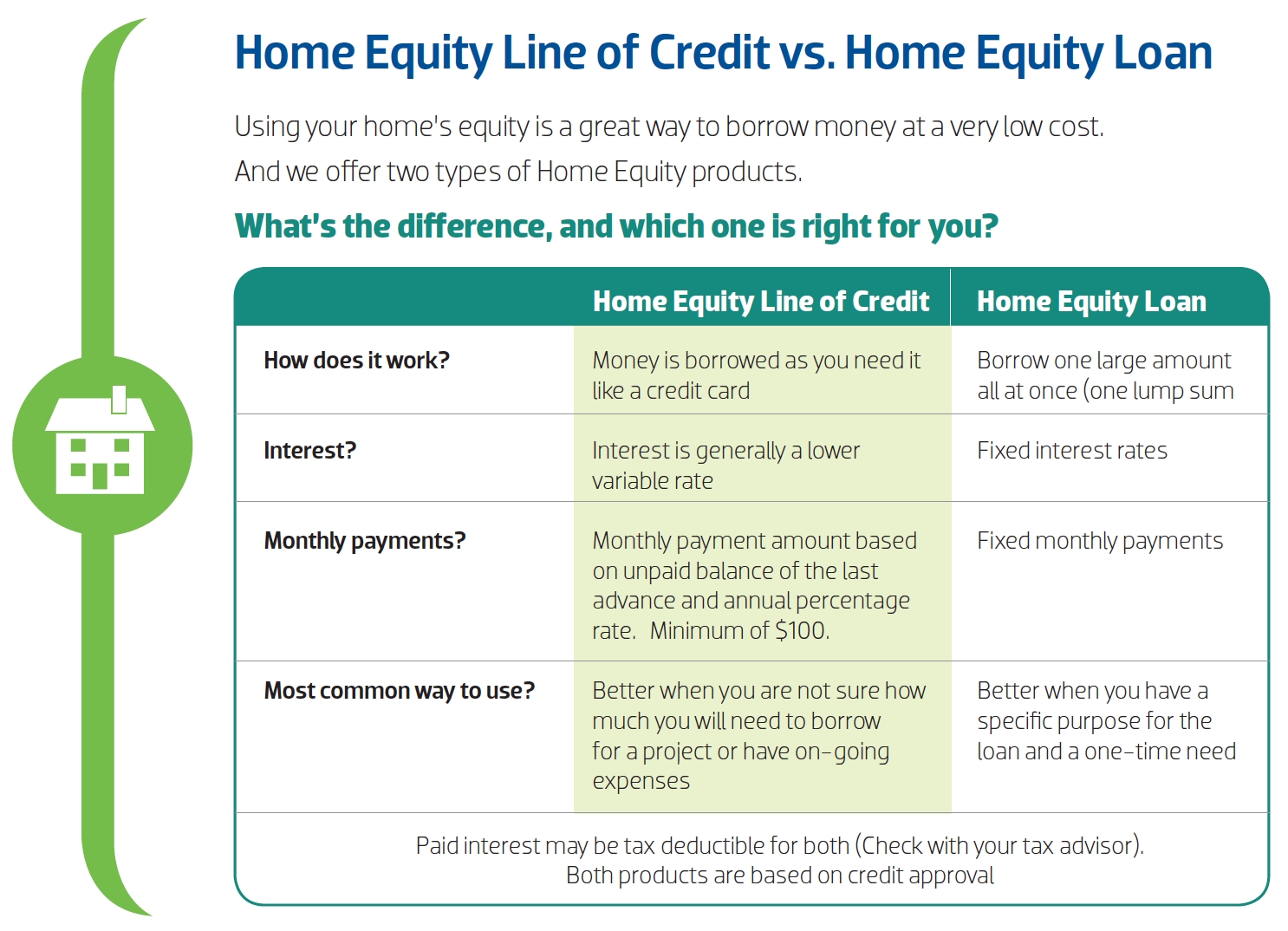

Legal fees cover a wide variety of legal needs such as representation, drafting of the sales agreement, and writing letters to utility companies regarding name changes, etc.

Sep 4, 2020 — The package offers these workers special rates on auto loans; mortgages and home equity and unsecured loans…. A home equity loan can be a better choice financially than a HELOC for those who know exactly how much equity they need to pull out and want the security of a fixed interest rate. Borrowers should take out home equity loans with caution when consolidating debt or financing home repairs. It is easy to end up underwater on a mortgage if too much equity is pulled out, leaving a borrower with ruined credit and a home in foreclosure. Determine the current balance of your mortgage and any existing second mortgages, HELOCs, or home equity loans by finding a statement or logging on to your lender’s website.

Starting APRs are based on borrowers having the best credit profiles and applying for an LTV of 80% or less. It also includes a 0.25% initial rate discount when a borrower sets up automatic payment from an Old National checking account. Keep in mind that each lender charges different amounts for home equity loan fees, and some lump multiple types of fees together. Some lenders even offer no closing cost home equity loans, which prevent upfront costs but can result in a higher interest rate for the life of the loan. A home equity loan functions much like a mortgage where you’re provided a lump sum up at closing and then you begin repayment.

No comments:

Post a Comment